The One Financial Decision That Changes Everything in Relationships

Relationships are complicated.

Circumstances are unique.

Every couple has their own idiosyncratic way of handling money.

These ideas have led us to steer clear of talking about today's topic in past newsletters.

But after years of witnessing couples struggle with money and after the emergence of new research, we felt compelled to talk about this third rail of relationships: the decision to share or split financial accounts.

Our perspective?

Sharing accounts is perhaps the most important structural move modern couples can make to create a culture of connection, love, and radical generosity.

Why?

Here are two reasons.

1. The research is clear.

Marriage researchers have been examining this question for decades and have identified numerous benefits of sharing accounts.

In a recent study titled, "Common Cents: Bank Account Structure and Couples' Relationship Dynamics," for instance, researchers looked at both newlyweds and couples fifteen years into marriage.

They discovered that:

- Two years after merging their accounts, newlywed couples experienced higher levels of relationship satisfaction and financial harmony.

- Two years after keeping separate accounts, by contrast, newlywed couples experienced declines in both areas.

- In both newlywed and couples married for fifteen years, shared accounts led to significantly higher levels of generosity.

Put simply, couples who share accounts tend to be happier in their relationship, more financially aligned, and more generous toward each other.

2. The incentives are even clearer.

This research is helpful. But it doesn't quite explain the why behind the advantages of shared finances.

We think we have the beginnings of an answer.

Couples who share accounts are incentivized to work toward shared success.

Couples with separate accounts, by contrast, are incentivized to work toward individual success.

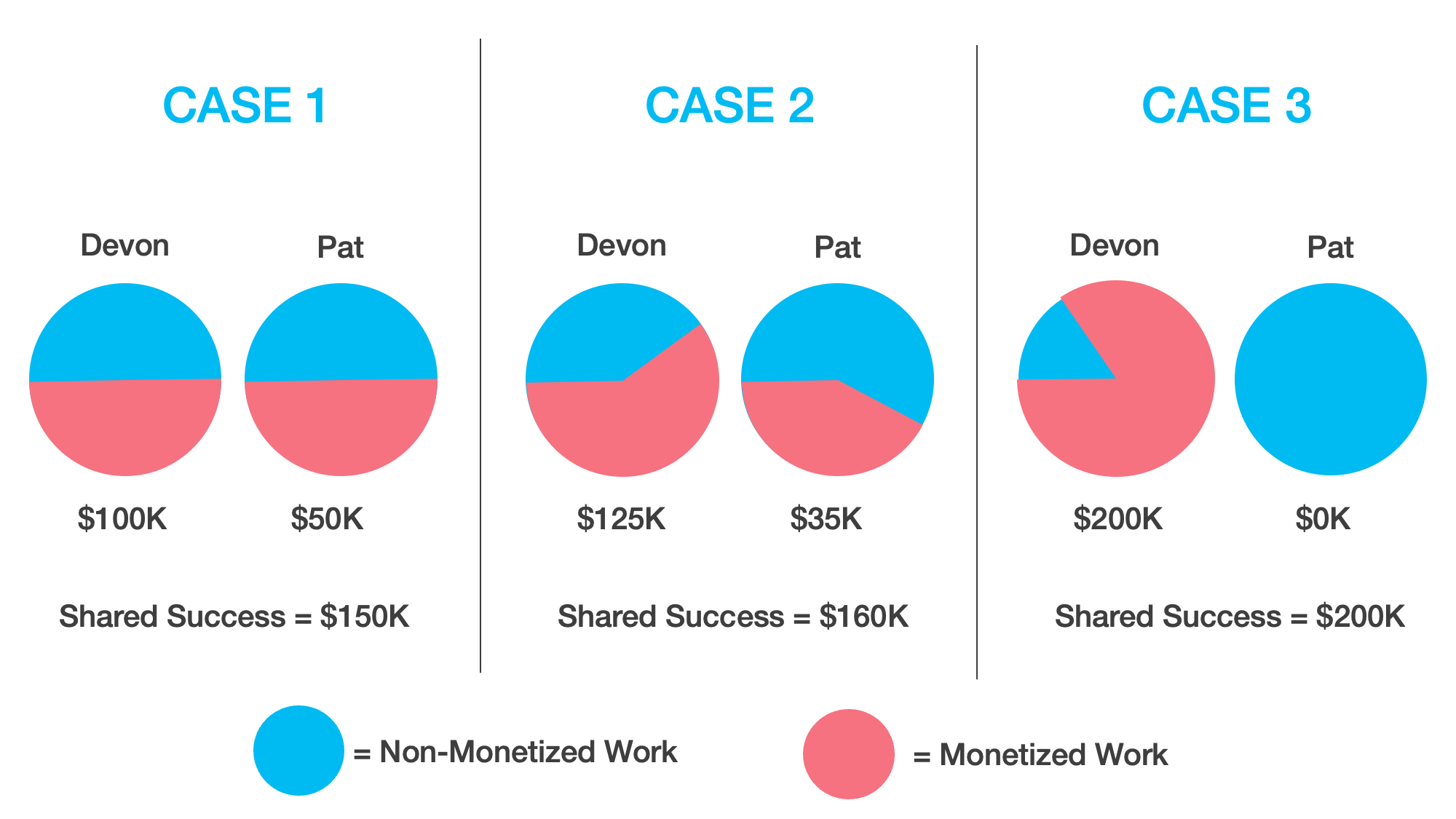

To make this less abstract, consider Devon and Pat. In this pair, Devon has the higher earning potential while Pat has the higher interest in the non-monetized work of caring for their kids, managing the house, and the thousand or so other logistics of daily life.

Like most couples, Devon and Pat could arrange their work and life in several different ways.

We are, of course, making a lot of assumptions here:

- We're assuming that both Devon and Pat are motivated to maximize their financial wellbeing.

- We're assuming that their life involves non-monetized tasks that take time away from work and other remunerative activities. Think childcare, housework, logistics, etc.

- And we're assuming that time is scarce -- i.e. that both partners must confront trade-offs between time spent on work versus time spent supporting the non-monetized work of the family.

So which arrangement should Devon and Pat choose?

If Devon and Pat have separate accounts, the answer is obvious: option 1 is the only rational choice.

While they would collectively have far more resources in option 3, this choice would be irrational for Pat. In this scenario, all of Pat's non-monetized work frees up time and space for Devon to make far more money than before.

The result? Since they have separate accounts, Pat now has nothing. Devon has everything.

If, however, Devon and Pat decide to share accounts, the entire world of incentives changes. They can now choose freely between all three of these scenarios.

And given their respective interests and earning potentials, Option 3 shifts from being a non-starter to increasingly interesting. They could, after all, have far more money for their family (their team) by pursuing this arrangement.

The point is that now they have a real choice.

Real life is, of course, far more complicated than the simplified case of Devon and Pat. And yet, the incentives we encounter are the same.

Their case shows that separate accounts close off all sorts of creative options, subtly pushing partners away from shared success, toward individual success.

What's the practical upshot of all of this?

If you have separate accounts and it's working for you, there's no need to change anything.

But if it's not working, you might consider opening up a conversation with your partner. You don't have to scrap the prenup and move all of your money into a single bank account tomorrow.

But it might be interesting to explore new ways to create more commonly held accounts, investments, and resources.

The more you share in common, the more incentivized you are to win together.

Want more of these life tools delivered to your inbox?

Sign up for the Klemp Insights Newsletter.